Learner Driver Insurance from 71p/day*

Learner driver insurance helps you get extra driving practice in your own car, or in a friend or family member's car, completely legally, without risking their No Claims Bonus**.

We offer great value learner driver insurance for UK provisional licence drivers, from 28 days up to 12 months. Choose your length of cover, get a quote in minutes, then get behind the wheel and start driving!

What is provisional insurance?

Learner driver insurance (also known as provisional driver insurance) is a type of cover specially designed for people learning to drive. It gives you more opportunity to learn to drive in a family member or friend's car, so you can reduce driving lesson costs while preserving the car owner's No Claims Bonus**. This can be affected if they add you to their insurance and you have an accident.

You can also get learner insurance for your own car, and with it you'll have the opportunity to start earning your own accelerated No Claims Bonus**. Provisional insurance helps ensure you're driving in line with DVSA (Driver and Vehicle Standards Agency) learner driver regulations.

Check out our Ultimate Learner Driver Insurance Guide to learn more about provisional insurance, or get in touch with our friendly team if you have any questions.

How does learner driver insurance work?

Choose your learner driver insurance duration. With options for a whole year, known as Annual Cover. Or for a shorter time with Short Term Learner Driver Insurance starts from just 28 days – perfect for that extra practice you might need to boost your confidence before your driving test.

Next, fill in a short form to get your learner driver insurance quote. All we need is your name, contact details, date of birth, occupation, and vehicle information (including registered keeper's details – usually the owner).

With just those few details, we’ll give you a provisional insurance quote in minutes – our great rates start from just 71p per day*. Perfect if you’re studying or working part-time.

Pay for your learner insurance cover via credit or debit card. Within minutes, you'll be good to drive. It's perfect if you want to get practice in to stop your three point turns turning into nine, and become an all round bite point boss, even on hill starts!

As a provisional licence holder, why do I need learner driver insurance?

You'd like to learn to drive in your own car with your driving instructor. That way you can learn and famliarise yourself with the quirks of the car you'll be driving once you pass your driving test.

You want to learn with a friend or family member in their car. That way, you can get plenty of helpful advice and tips – you could even log your practice and show it to your instructor.

You'd like to practice driving separate from your lessons, on different roads, in various conditions, at all different times of the day. After all variety is the spice of drive!

Get a quote today!

What are the benefits of learner's insurance on your own car?

Get much-needed driving experience

The DVSA advises learners to get more experience, such as driving on country roads and in the dark. Learner driver insurance means you can get this crucial know-how.

Flexible provisional insurance for every learner

Our learner driver insurance matches how you learn to drive. You can go annual, or if you only need short-term cover right before your test, you can get that too – topping up your cover or leaving short gaps.

No curfews when you're learning to drive

No limits on the times you can practice! You can get the most from your new learner driver insurance at any time – like in the evening, when the roads are quieter and you have space and time to perfect those tricky manoeuvres!

Accelerated No Claims Bonus for learner drivers**

If covering your own car with learner's insurance, you can begin earning No Claims Bonus**. This means you can start lowering your long term insurance costs right away!

What are the benefits of insurance for learner drivers on a parents' cars?

A Safe No Claims Bonus**

With learner driver insurance, you can insure your child to drive your car with zero risks to the car owners No Claims Bonus**.

Reduced Lesson Costs

Private practice is an excellent way of reducing the cost of learning to drive whilst increasing the experience and confidence of the learner driver.

Flexible Training

You can give your child a more flexible way of learning to drive. With learner insurance, they don't have to always work around a driving instructor's schedule.

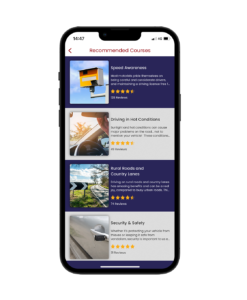

Get a free premium learners' app with your cover!

Packed with DVSA approved friendly lessons, tests and tips, the RoadHow app can help you learn quicker and become a better and safer driver – all from your phone.

RoadHow premium is rated 4.7/5 on the Apple Store and has over 10,000 downloads on the Google Play Store. With RoadHow, you can:

- Take DVSA approved theory tests

- Practice Hazard Perception clips

- Identify areas you can improve your driving

- Keep up to date with the latest road news and stories

Premium access to the RoadHow app comes free when you purchase annual or short-term learner insurance. We think it's a fantastic resource that can undoubtedly help you on your way to getting that pink licence.

Get your learner driver insurance quote today

Annual learner driver insurance

Our annual learner's insurance starts from as little as 58p per day*. It's perfect if you're a brand-new learner starting to drive. And because it'll be in your own name, you can earn your own accelerated No Claims Bonus** too.

Short-term learner driver insurance

You can get short-term learner's insurance is available from 28 days to 24 weeks with the ability to top up from just seven days. Our short-term young learner driver insurance policies are flexible too – you can have gaps in your cover and top up when required, no stress.

Who can teach me that is not my driving instructor?

When you're driving with learner driver insurance you always need a supervisor with you. Your supervisor must always sit in the front passenger seat. They're there to help, give advice, stop you freaking out when an inconsiderate driver beeps – that sort of thing!

It does not need to be the car owner that supervises you when you are learning to drive, but they must meet the following criteria:

✓ Be at least 21 years old

✓ Qualified to drive the vehicle type you are driving (e.g. a manual licence if you are driving a manual car)

✓Held a full UK or EU licence for a minimum of 3 years

Why choose Collingwood learner driver insurance?

✓ Great Customer Service – We're rated 'Excellent' on TrustPilot

✓ We're Award Winning – Recently winning the Best Car insurance Provider at the 2022 ICA's

✓ Competitive Insurance Quotes – We pride ourselves on affordability with Annual insurance available from 71p/day*

✓ Get a Quote in Minutes – Fill in a quick form, get your quote, then start learning

✓ Flexible Insurance – Choose your insurance term, from 28 to 365 days

Learner Driver Insurance FAQ's

Get answers to all your learner driver insurance questions below. We also have a more detailed FAQs section available and you can head to our blog In The Driver's Seat for the latest provisional driver news, hints and tips too.

Do learner drivers need insurance?

If you drive your own car or a family member or friend's vehicle while you have a provisional licence, you need to get insurance before you pass your test. You can either get added to the car owner's insurance, or get dedicated learner driver's insurance, only the second option protects the owner's No Claims Bonus though.

How much is learner driver insurance?

Our provisional insurance quotes change depending on lots of factors, including the type and age of the vehicle and age of the learner, so we can't give an estimate here.

That said, our cheap insurance rates start from as little as 58p* per day, making them affordable for learners on a wide range of budgets.

Do I need insurance to supervise a learner driver?

If you want to supervise a learner driver, both of you must be insured if you are driving your car.

If the learner owns their own car, then they must be covered, but you must be over 21, qualified to drive the car, and have a full licence for three years in the UK, EU, Switzerland, Liechtenstein or Iceland – you do not need to be insured on their car however.

Can I add a learner driver to my insurance?

In most cases, you can, though it depends on the ins and ours of your insurance policy.

That said, by not choosing owner learner driver insurance, you can risk your No Claims Bonus – for example if the learner reverses into another car or oversteers on that roundabout! That's why learner insurance is often a better option than simply adding a driver.

As a vehicle owner, do I need to have my own insurance policy on the vehicle that the learner driver is insuring?

Yes. As the registered owner or keeper of the vehicle, you must have the vehicle insured in your own name for the duration of the learner driver insurance policy.

As the vehicle owner, must I supervise the Provisional Driving License Holder if they are driving my car?

Not necessarily, no. The learner driver must be accompanied by a person over the age of 21, who has held (and still holds) a valid full UK driving licence in the same category as the vehicle they are driving, for at least 3 years – it doesn't just have to be the vehicle owner.

What if I drive without learner driver insurance?

It's illegal to drive without valid insurance in the UK.

If you don't have specialised UK learner insurance or haven't been added to the insurance of the owner of the car you are driving, you could get an unlimited fine, up to eight penalty points on your licence, and be banned from driving.

Is learner driver insurance the same as dual insurance?

Dual insurance is a situation where a car has the exact same cover across multiple insurance policies – such as if a car were to be insured for two people across two main policies instead of a main policyholder simply adding a named driver. Learner insurance differs in that it's a different type of cover. That means it still offers value for money.

Can I get learner's insurance if I'm 17 years old?

Yes, you can. All our learner driver insurance policies can cover 17-year-old drivers.

What is the excess on learner driver insurance?

It can differ. Your insurance schedule will detail how much your excess is. For more information, chat to us live below.

Do you need L plates for provisional insurance?

Yes, you do. Your car, or the car you are named on, should be fitted with front and rear L plates – or D plates if you are in Wales.

L plates are no bad thing – everyone was a learner once, and they mean other drivers might be a little more patient with your driving than they might otherwise be!

Can ANPR detect provisional insurance?

Automatic Number Plate Recognition (ANPR) is used to detect whether a car is insured, taxed, and has a valid MOT, but it cannot detect who is driving the car and the level of insurance that driver has.

However, if a car is found to have been driven by someone with the incorrect insurance or no insurance at all, you could be fined a fixed £300 penalty and be given six penalty points, receive an unlimited fine, or even be disqualified from driving indefinitely.

Is learner driver insurance different to provisional insurance?

Learner driver insurance and provisional licence insurance are the same thing. They each cover a learner driver while they practice driving with a friend or family member, in their own car, or the other person's car.

Can more than one learner driver be on the same policy?

Each learner driver is required to hold their own insurance policy. However, more than one learner driver can drive the same car.

Can I take my driving test in my own car?

Yes. You will need to take your learner insurance policy documents with you and make sure the car meets certain requirements set by the government. You can see some of those below, but we advise that you read the full list of requirements on the government website.

- The car must be taxed.

- The car must be in a roadworthy condition.

- If the car is over three years old, it must have a current MOT.

- There must not be any warning lights lit up, for example the airbag warning light.

Can I earn a No Claims Discount while I learn to drive?

While you will not earn a traditional No Claims Discount, following the termination of your learner driver insurance policy and having completed at least 10 consecutive month of claim-free driving, we will provide a letter on a single occasion confirming an entitlement to one year's worth of No Claims Discount for presentation to a new insurer. It's worth noting that these are not done automatically and must be requested.

Can I purchase Collingwood Learner Driver Insurance on more than one vehicle?

You can cover more than one vehicle, but you'll need to buy a separate policy for each vehicle. Log in to your existing online account and click 'New Quote' to start the process.

I haven't found a driving instructor yet, can Collingwood help with that?

While we can't specifically recommend a driving instructor to suit your requirements, we do have our handy Find an Instructor tool. All you need to do is enter your postcode and our helpful tool will locate driving instructors that are close to you.

Get in touch about your learner's insurance quote today

Our team are always on hand to answer your questions and help you get a provisional insurance quote that gives you all the cover you need while suiting your budget. Contact us today or chat to us live via the bottom right message icon.

*Price correct from 04/03/2024 based on Annual price price excludes IPT and admin fees.

**Subject to terms, conditions and underwriting criteria